100% TRANSACTION REVIEW

100% SUCCESS RATE

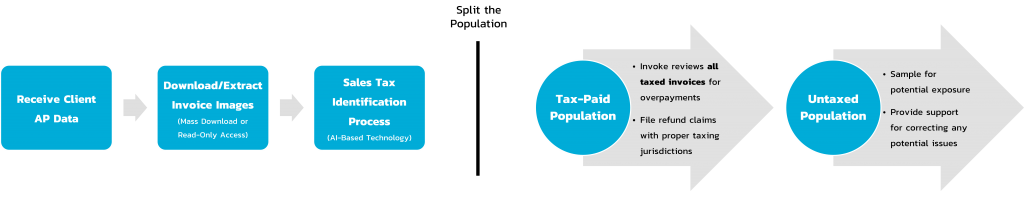

Invoke Tax Partners has created a proprietary sales tax identification process that provides a complete view of all sales tax paid to vendors by our clients. Our proprietary software developed in-house allows us to review 100% of uploaded electronic invoices for sales tax charged to maximize our clients’ sales tax refunds and identify areas of potential exposure. By implementing this process, sales tax reviews by Invoke are executed with the upmost speed, accuracy, and completeness known in the industry.

Through the years Invoke has worked diligently to provide our clients with complete reviews of all transactions to ensure they receive the highest level of service and assurance that they have a complete picture of their sales tax expenditure. As the market and industry have changed, so has our approach on how we service each client’s unique needs. Therefore, the expert sales and use tax consultants at Invoke have created a software that allows us to review large volumes of electronic images, which are the new standard of record retention, for sales tax charged on an individual invoice. Our technology gives us the ability to review bulk invoice images and create a taxed and non-taxed population for our experienced sales and use tax consultants to review. This guaranteed review of all invoices, regardless of dollar amount, allows us to uncover sales tax savings opportunities that are frequently missed during overpayment reviews and sales tax audits, with zero disruption to your daily operations.

Benefits

Invoke’s Sales Tax Identification Process reviews 100% of uploaded payables invoices to identify only those where taxes have been paid. Benefits of this process include:

Maximized Refunds

Reviews 100% of payables for tax overpayments

Increased Efficiencies

Proprietary system allows for faster turnaround and review process

Holistic Insight

Allows for non-taxed vendors to be sampled for exposure creating a complete picture of vendor issues

ENGAGING INVOKE FOR SALES TAX AUDIT DEFENSE OR OVERPAYMENT REVIEWS

Invoke’s audit defense and overpayment review services begin with this proprietary sales tax identification process at no cost obligation to the client. The engagement starts with the extraction of invoice images from your imaging system so our team can load them into our proprietary and secure software for review. Often this can be done with read-only access to the client’s imaging system. From there, our experts will handle the process completely so your business can maintain vital daily functions without disruption.

SALES AND USE TAX CONSULTANTS

Our sales and use tax consultants have a history of recovering overpaid taxes, reducing tax liabilities, and minimizing future state tax exposure by implementing best practices and technology. With a long history and intimate knowledge of nationwide sales and use tax laws, our team prioritizes building meaningful partnerships to serve as an agile extension of your accounting department. Our determination to achieve our clients’ goals allows us to serve as a single-source tax firm for some of the nation’s largest organizations. Contact our team today to consult with an expert on where you may be able to uncover valuable sales and use tax savings.

Scott Schwertner

National Director of Sales & Use and Severance Tax

Meet Our Sales & Use Tax Practice Leader

Scott Schwertner leads the Sales & Use Tax Team for Invoke. Scott has 20 years of Sales and Use Tax experience and has worked across the United States for some of the largest manufacturing, chemical and oil and gas companies. He has extensive experience completing refund projects, audits and managed audits. Scott has spent his entire career providing professional and ethical Sales and Use Tax saving services, and his commitment to clients has created lasting business and personal relationships over the past two decades. Scott holds a BBA in Accounting from Texas A&M University.