HOLISTIC PROPERTY TAX SAVINGS FOR MULTI-STATE COMMERCIAL REAL ESTATE INVESTORS

Multi-state commercial real estate portfolio owners face distinctive challenges and are required to meet unique tax laws in the commercial property tax landscape across the nation. There are significant nuances due to the niche nature of owning commercial real estate in more than one region, making expertise in this area imperative when finding a property tax partner.

The Invoke Tax Partners team has decades of experience working with some of the nation’s largest portfolio REITs and institutional investors to ensure not only fair property valuation and taxation, but also accurate and comprehensive pre-acquisition tax estimates, and provides comprehensive state and local tax services in all 50 states. Our understanding of local market nuances across the country and our holistic approach to taxation make property tax partnership with Invoke an optimal choice for nationwide commercial real estate portfolios across all asset classes.

Contact our nationwide commercial property tax experts today to consult with our team. Our dedicated property tax professionals will review your portfolio to help determine where you may be able to uncover additional savings opportunities, as well as provide experienced insight prior to your next acquisition. Simply fill out this form to be connected with an Invoke expert that matches your company’s portfolio:

Seamless portfolio transitions

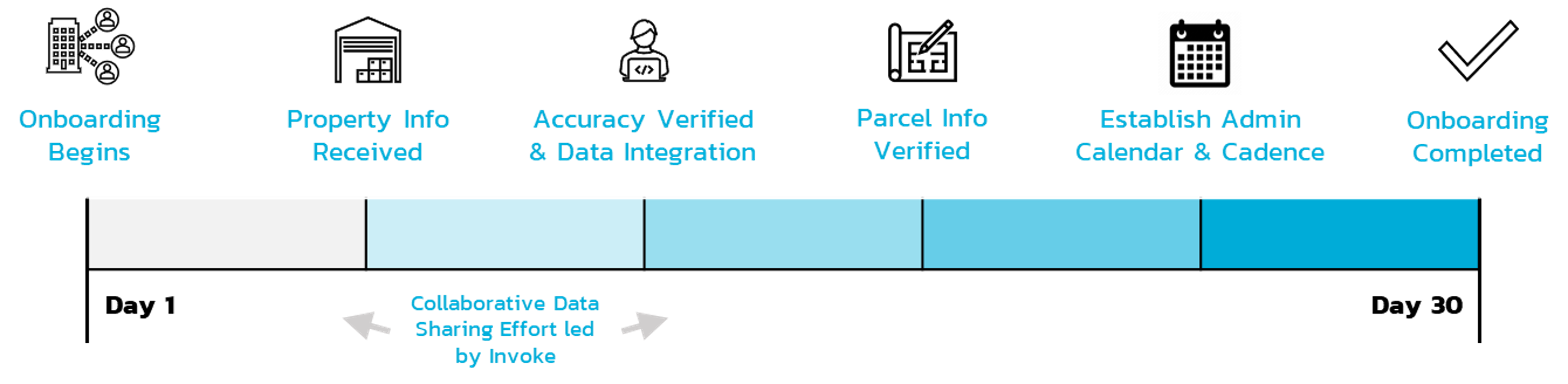

Invoke’s client relationship experience begins with a Transition Team to bridge the handoff to Operations within the first 30 days of engagement. The Transition Team works collaboratively with our clients and their internal stakeholders to ensure a comprehensive service plan is established and that all data and software platform integration is executed.

After our onboarding process is complete, Invoke’s dedicated Transition Team works collaboratively with our clients, their relationship manager, and other internal stakeholders to ensure a comprehensive service plan is established and that all data and platform integration is executed at the offset of the engagement, allowing maximum efficiency and minimal downtime from onboarding to results.

For clients with an impressive national footprint, we have compiled several Case Studies that represent our property tax appeal capabilities in conjunction with our ability to transition and quickly impact large nationwide portfolios. These specific client examples are of portfolios Invoke has onboarded in the past 18 months and the immediate property tax savings we achieved for these clients. The last client example shows a legacy portfolio client of Invoke’s.

Multi-State Portfolio Property Tax RepresENTATION

Invoke Tax Partners understands that the property valuation and taxation process can present unique challenges for commercial real estate owners and investors when properties are owned in many states across multiple asset classes. Varying tax laws, nuances, and deadlines presented county-by-county can result in missed appeals, under-advocated properties, and ultimately, overpaid property taxes.

When dealing with multiple asset classes (e.g. multifamily, industrial, office, retail, hospitality) our clients are also presented with the unique challenge of facing inconsistencies in reporting. While seemingly inconsequential, this is a challenge that when overlooked, can result in uninformed decisions about portfolios and potentially threaten the bottom-line. Invoke has created a reporting system that is customized to each of our national portfolio clients and provides consistent data that is integral to decision making regarding acquisitions, budgeting, and property tax strategies as a whole. This customized approach is one that is unique to Invoke as a boutique national property tax firm, provding some of the nation’s largest commercial real estate owners a distinctive level of care and attention they cannot find elsewhere.

James Sutton

Partner / National Director of Property Tax

Meet Our National Property Tax Practice Leader

James Sutton is the National Director of Property Tax at Invoke Tax Partners. Since partnering with Invoke, James has led the charge of optimizing the property tax practice through the infusion of experienced talent, innovative processes, and a laser-focus on delivery of results. In his role, James leads execution from the Real Estate and Personal Property Tax departments at Invoke. Over his 15+ years in the industry, James has continually delivered the successful execution of national property tax engagements with customized and proactive solutions.