LEARN MORE

Property values in Texas are reappraised every year. With some of the highest property tax rates in the nation, owners and investors of Texas commercial real estate and business personal property need to be aware of dates and methods they can utilize to ensure they are only paying their fair share in property taxes.

Contact our Texas property tax consultants to ensure your properties are fairly valued and taxed upon receiving your value notices:

INVOKE’S TEXAS PROPERTY TAX PRACTICE

Our highly-experienced Texas property tax Senior Managers carry below industry average property counts under representation in order to maximize their time spent on each property. This ensures our clients’ portfolios are receiving the attention they deserve. The philosophy of Invoke’s Texas practice is based on specialized experience by asset class. Our Consultants possess an industry-leading, in-depth knowledge of the latest valuation techniques, appeal procedures, and Texas property tax law for their respective property types including office, retail, industrial, multifamily, hospitality, and manufacturing.

WHAT TO EXPECT WITH YOUR NOTICE OF APPRAISED VALUE

Commercial property owners should expect large increases on noticed values for Texas this April. The increases will be led by multifamily and industrial properties followed by office, retail, and hospitality.

WHAT TO DO WHEN YOU RECEIVE YOUR VALUE NOTICE

First, contact your property tax consultant to ensure an appeal is being filed. Second, send your consultant all relevant information to value the property if you have not done so already. Then establish a value you believe the property should be assessed at based on a market and equity approach.

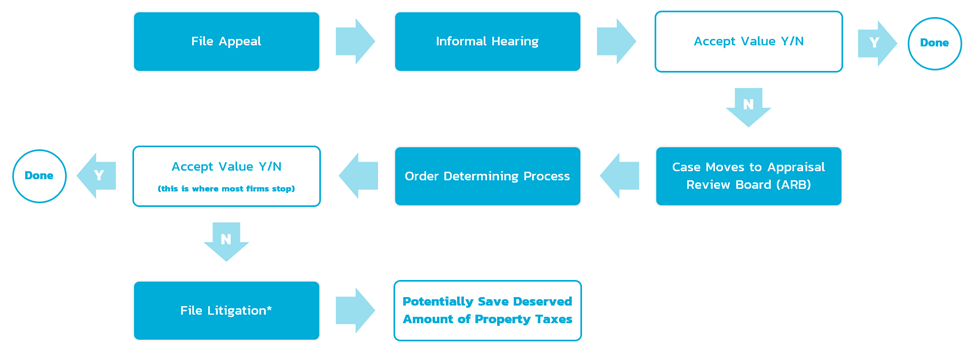

TEXAS PROPERTY TAX APPEAL PROCESS

Texas owners and investors of commercial real estate and business personal property should have a formal plan to appeal their notices of value every year. Invoke recommends working with experienced Texas-based property tax consultants to navigate the traditional appeal cycle.

TEXAS PROPERTY TAX COVERAGE

Invoke’s Texas practice provides coverage throughout the entire state. This includes the major Texas counties of:

LATEST TEXAS COMMERCIAL REAL ESTATE NEWS FOR 2023 PROPERTY TAX SEASON

Texas Multifamily Property Cap Rates Continue to Rise Though Assessed Values May Not Decrease

James Sutton

Partner / National Director of Property Tax

Texas Property Tax Leadership

James Sutton is the National Director of Property Tax at Invoke Tax Partners. Since partnering with Invoke, James has led the charge of optimizing the property tax practice through the infusion of experienced talent, innovative processes, and a laser-focus on delivery of results. In his role, James leads execution from the Real Estate and Personal Property Tax departments at Invoke. Over his 15+ years in the industry, James has continually delivered the successful execution of national property tax engagements with customized and proactive solutions.