In 2020, real estate investing slowed as the world shut down due to COVID-19. However, real estate investors have reappeared and are focusing highly on Texas’ largest growth regions. Dallas-Fort Worth currently holds the top spot for commercial real estate investments, as new and old investors flocked to DFW, Houston, Austin, and San Antonio in 2021.

Given the tremendous real estate growth in Texas each year, investors who are recently adding these areas to their portfolios may be shocked in April when they receive a Notice of Value from the Central Appraisal District. Unlike other states, Texas property taxes are high, and assessments can increase dramatically year by year. To mitigate the increased assessments, property owners will hire a property tax firm, such as Invoke Tax Partners, to appeal the assessed value and thus lower their property taxes liabilities.

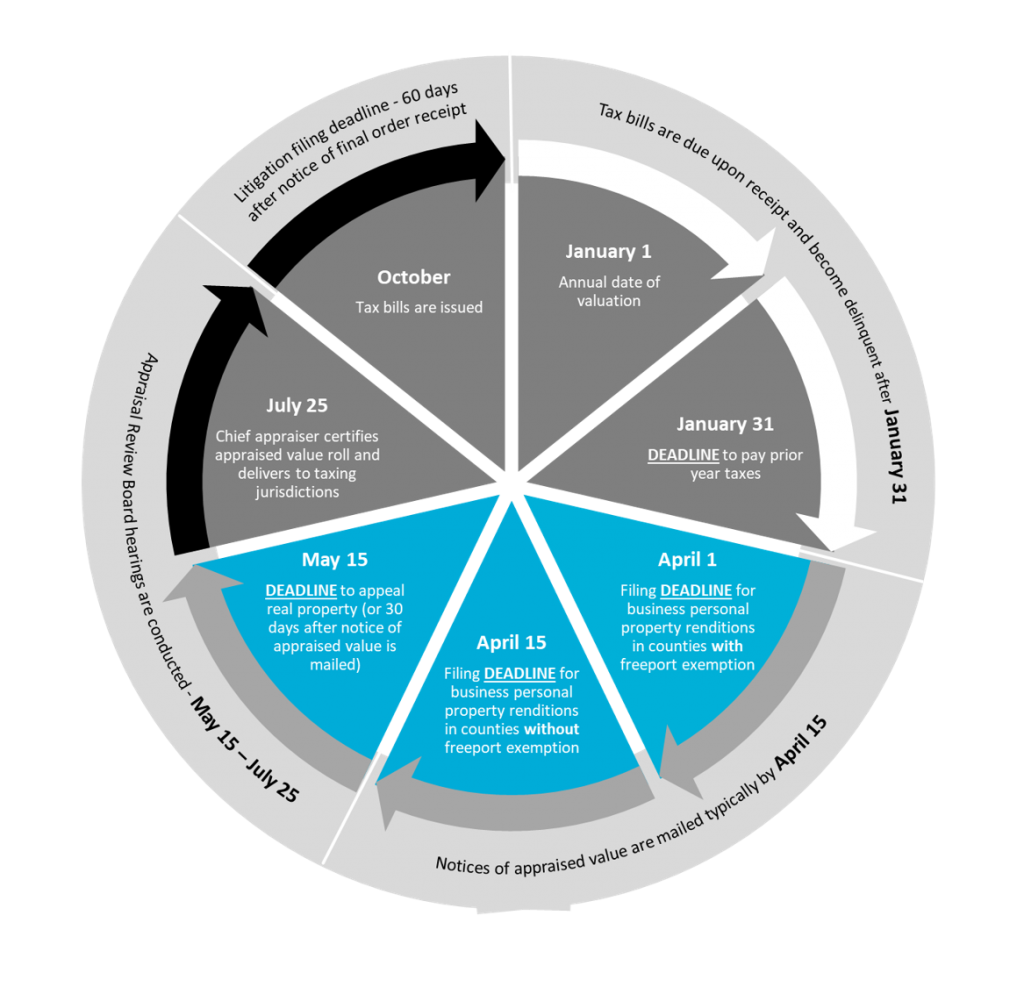

1/1 – Lien Date: Appraisal districts in Texas must reassess properties at a minimum of once every three years. However, on large assets and in active markets. the assessor will likely reassess the property annually. For new Texas real estate investors, we recommend operating under the assumption of annual reassessment, unless otherwise notified, particularly for their largest new commercial assets.

4/15 – Notice of Assessed Value: By 4/15 the county assessors will publish the proposed assessed values. An assessor must send notification by mail if the property value increases year over year. If the value on your commercial real estate investment remains the same or decreases, no notice will be sent. However, the value should be reviewed annually by a property tax professional regardless of fluctuation status.

5/15 – Appeal Deadline: The appeal deadline is 5/15 or 30 days after notification, whichever is later. Because of the short turnaround time and complexities within Texas property tax laws, we recommend engaging the expert consultants at Invoke Tax Partners prior to the receipt of your assessed value to ensure your appeal is filed well within your 30-day window.

May – July – Appraisal Review Board (ARB) Hearings: After a property tax appeal is filed, the ARB will send a notice for a hearing date. The hearings generally take place between May and Mid-July. However, COVID has caused some hearings to be conducted into the fall. A property owner or their property tax consultant may discuss the property value before the hearing date to reach a settlement. If a settlement cannot be reached, it will proceed to a scheduled 15-minute hearing.

7/25 – Appraisal Roll Certified: By July 25th the Chief Appraiser of each county must prepare and certify the appraisal roll for each taxing unit in the district. This means the Appraisal District and ARB must be complete with 90% of the value for all properties.

Aug-Sept – Arbitration/Litigation Deadlines: After an ARB hearing, the ARB will send the property owner and property tax consultant a Notice of Final Order. If you elect to appeal the ARB decision, you have 60 days to file arbitration or litigation. To file Arbitration, the property value must be below $5M, however, any property is eligible for litigation. Should we recommend additional litigation for your commercial properties, your dedicated property tax consultant at Invoke will work directly with you and all necessary personnel to complete Arbitration filing.

October – Property Tax Rates and Bills: The taxing entities adopt their tax rates in September and tax bills are issued starting on 10/1. Tax bills are due upon receipt; however, they are not delinquent until January 31st. In 2019, legislation was passed that limits revenue increases year over year for taxing units. This essentially forces tax rates to decrease as values increase.

1/31 – Taxes Due: Property taxes are due. Penalties and late fees begin on 2/1.

For more information regarding Texas property taxes and how Invoke Tax Partners may be a resource for your Texas commercial real estate portfolio, please contact Alex Pace.

Director of Property Tax – Central Region

As Director of Property Tax for the Central Region, Alex will lead property tax operations by growing and attracting industry-leading talent, developing best in class valuation methodologies, and representing some of the largest commercial property owners in the state of Texas.