Optimizing Nationwide

Property Tax Compliance

Invoke’s personal property tax consultants have experience in all states that impose personal property tax and have the resources to efficiently file and maintain tax returns and exemption forms for each taxing jurisdiction across the country. We tailor our high volume business personal property tax services to meet your needs, from providing labor to fulfilling compliance and rendition requirements, to advising you on the most advantageous valuation methodology to implementing the best technology options.

Our high volume business personal property tax team utilizes best-in-class technologies and methodologies to timely and efficiently file mass renditions and exemption forms.

Aside from demanding a profound understanding of the procedures and laws associated with local taxing authorities, the personal property tax compliance process also requires a system that guarantees timeliness so that all deadlines are met. When working with a high volume nationwide of assets, this process requires a level of attention to detail that can only be met by an experienced team of analysts, making outsourcing this function an optimal choice for operations of all sizes.

By The Numbers

Business Personal Property Tax

25,000+

Returns Filed Annually

130,000+

Tax Bills Processed / Paid Annually

$300+ M

Tax Bills Processed / Paid Annually

Our Approach

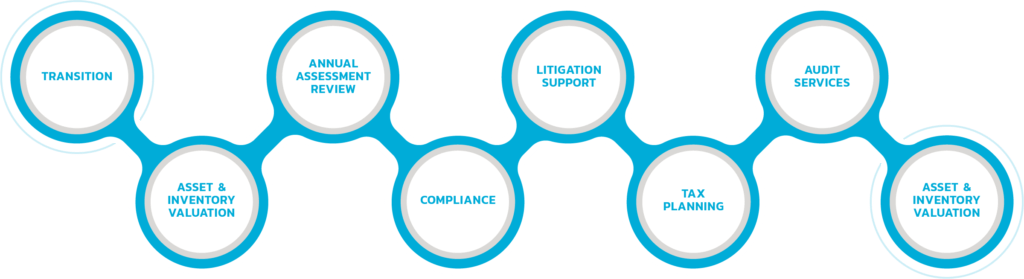

Complying with personal property tax rendition filings is very time consuming and expensive. Missing deadlines, or failing to file completely, can be extremely costly to your bottom line. Invoke has developed an approach that has built in cost efficiencies and complete accurate outsourcing with seamless transitions among services. After account transition, our process begins by correcting the frequent errors seen in the high volume compliance space: identifying missed closed accounts, duplicate accounts, mass over-valued assets and claiming personal property tax renditions not yet received. Once our baseline is established through our intensive initial asset inventory and valuation process, we are able to move forward with a streamlined approach to maximize efficiences year over year.

Our Results

High volume business personal property tax renditions are a cumbersome undertaking for organizations, especially those who operate in multiple states. The following case study is an example of how Invoke takes over and ensures compliance with the rendition process across all states that tax business personal property.