Nationwide Business PErsonal Property Tax Rendition Filings

Personal property tax compliance can become exceptionally complex when dealing with state and local taxing authorities from multiple states and jurisdictions. Complying with property tax rendition filings and exemption forms is time consuming and expensive. Proper execution of each of the elements in the personal property tax compliance process are paramount to achieving accurate valuations annually, and not risking continuous overpayments as tax rates continue to rise nationally. Missing deadlines, or failing to file completely, can be extremely costly to your bottom line. Invoke has developed an approach that has built in cost efficiencies and results in complete and accurate outsourcing with seamless transitions among services.

Aside from demanding a profound understanding of the procedures and laws associated with local taxing authorities, the personal property tax compliance process also requires a system that guarantees timeliness so that all deadlines are met.

Invoke has the resources to efficiently file and maintain tax renditions and exemption forms for each taxing jurisdiction across the country. We tailor our services to meet your needs, from providing premier talent, to fulfilling exemption and rendition requirements, to advising you on the most advantageous valuation methodology. Additionally, our use of industry leading technology platforms, PTMS and ONESOURCE, streamlines the overall compliance processes, eliminates manual data entry, manages documents, and provides analytical tools to save both time and money.

By The Numbers

Business Personal Property Tax

25,000+

Returns Filed Annually

130,000+

Tax Bills Processed / Paid Annually

$300+ M

Tax Bills Processed / Paid Annually

Personal Property Tax Compliance Rendition Filings

When handling high volume personal property tax compliance and Rendition filings, the ability to maintain records, understand the state and local tax laws and successfully manage varying deadlines is imperative. Having high volume personal property tax compliance expertise spanning the entire nation, Invoke’s team of expert consultants retains consistently updated filing methods and proactively improved methodologies to specifically address the nuances of reach state taxing authority. This proactive approach to allows us to remain prepared in the event of a business personal property audit in all 50 states.

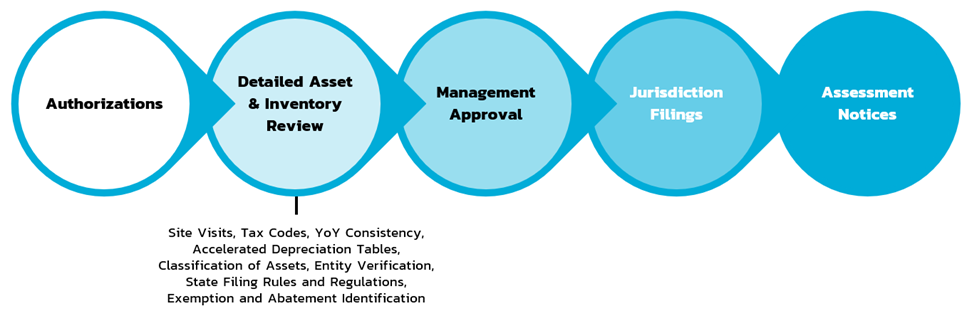

Our typical rendition preparation and review process follows the below general guidelines:

Personal Property Tax Compliance Software

Invoke Tax Partners’ preferred personal property tax compliance software programs, PTMS and ONESOURCE provide full visibility and dashboard access to our clients through a managerial view of what is inside the system. Cloud-based and updated in real-time, these programs allow for the receipt of automated notifications of completed tasks and pending deadlines, and the ability to monitor progress with key performance indicators. This software utilization streamlines the overall compliance and rendition process, eliminates manual data entry, manages documents, and provides analytical tools to save both time and money.

In addition, Invoke has built a system of edits and reports that bolt onto the back end of our software partners. These automated controls verify staff adherence to internal policies and procedures, assure that all steps are completed and provide a tailored level of reporting to each client engagement, ensuring unparalleled transparency. The involvement and interaction of the operations, client relationship, and technology teams at this level is a best-in-class service combination.

The Invoke Advantage

Our personal property tax compliance team has developed a system that ensures accurate and timely execution of a streamlined compliance process, no matter how robust your portfolio. With a strategic national footprint serving all 50 states, Invoke Tax Partners has the resources to provide local coverage in every region. This network of local and expert representation allows us to proactively service your portfolio with personnel familiar with market nuances across the country, and handle all property exemptions, renditions, reviews, and appeals internally, severing as your single-source partner for personal property.

From an appeal, accrual, tax bill payment, reporting, and technological standpoint, our approach to developing proprietary systems and utilizing best-in-class software applications provides the transparency, accuracy, and security needed in a modern state and local tax landscape.

Seth Krchmar

National Director of Personal Property

Lead Consultant | Business Personal Property Tax

Based in our Atlanta, Georgia office, in his role Seth leads business personal property nationwide by utilizing the innovative valuation techniques and comprehensive management skills he has perfected over his time in the industry. Seth is predominantly responsible for growing and attracting high-level property tax talent as well representing some of the industry’s most prominent personal property and commercial real estate taxpayers.

His technical career has seen him representing high-profile clients in regard to compliance filings, assessment negotiations, fair market value studies, assets inventory/tagging projects, and securing credits/incentives.